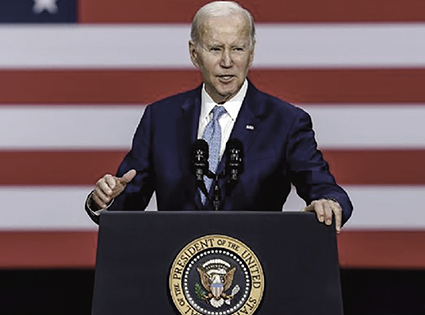

Joe Biden Signs Debt Ceiling Deal

On June 3, President Biden signed a bipartisan deal suspending the country’s debt ceiling until 2025. This puts an end to the tense budgetary discussions that have kept Washington, the U.S. financial system, and the international community deeply concerned about the unprecedented threat of a U.S. default, the economic crisis-inducing scenario in which the country would not have been able to comply with its financial commitments. Despite averting the crisis, debt ceiling showdowns are becoming increasingly common in Washington. For this reason, it’s important to know what exactly the debt ceiling is and what the implications of the bipartisan law that averted default are.

The debt limit is the maximum cap on the federal debt the U.S. government can accumulate. It was created by Congress in 1917 to expedite the process of government bond sales. However, as the size of the U.S. government has increased, so has the cost of running its operations. According to the Council on Foreign Relations, since 1960, the debt ceiling has been raised seventy-eight times, most recently in 2021, with forty-nine increases occurring under Republican presidents and twenty-nine under Democratic presidents. The need to raise it comes from the fact that as the size of the government increases, so does the cost of its operations. For instance, since 2001, the government has consistently operated with an average annual deficit of nearly $1 trillion. Therefore, borrowing to cover expenditures exceeding tax and revenue collections has become necessary. The process of raising the debt ceiling, through majority approval from both chambers of Congress, has traditionally been routine. It has been done swiftly with wide congressional support whenever the Treasury Department faced challenges paying bills. In addition, Congress also has the option to suspend the debt ceiling temporarily, allowing the Treasury Department to exceed the debt limit for a defined period. While rare in the first ninety years, Congress has suspended the debt limit seven times since 2013. In January 2023, both the national debt and the debt ceiling reached $31.4 trillion. So, concerns of a possible default started to be raised, especially because since 2011, the discussions around the debt ceiling have stopped being the routine process that they once were and became a tense political discussion that ended increasingly close to Date-X, the day when a default can start. In this case, Date-X was supposed to be June 5, so the bill was signed with just two days to spare. The impact of a default can be disastrous for the economy. In an Ethnic Media Services press conference, Shanon Buckingham, Senior Vice President of the Center on Budget, and Policy Priorities, warned of how it could impact vulnerable Americans: “65 million Social Security beneficiaries could have seen their benefits delayed. Six million veterans and their survivors could have had their benefits held up. Families could have seen their monthly rental assistance, food assistance, childcare delayed.” She later added, “If a default had extended, we could have seen millions of jobs lost.” A debt ceiling showdown has consequences beyond defaulting. It also has important implications for U.S. credibility abroad. The fact that these routine procedures become intense political fights is a signal of democratic backsliding, and even the possibility of defaulting causes doubts among investors. For instance, Fitch Ratings will keep the U.S. on “negative watch” despite reaching a budget deal. Furthermore, as the national debt continues to increase, interest payments become a larger part of the national budget. By 2033, they will exceed the size of programs like national defense or Medicaid. For Rachel Snyderman, this is a problem. In the EMS press conference, she stated, “It’s more important to kind of think about it in the context of what that spending crowds out. If our interest costs soon become our largest government program, what are we sacrificing? What are we not funding?” The deal reached between Biden and McCarthy does not seem to address this imminent budgetary concern. In fact, despite increasing work requirements for the Supplemental Nutrition Assistance Program, ending Biden’s student loan repayment freeze, and rescinding $1.38 billion from the I.R.S., and ultimately repurposing another $20 billion from the $80 billion it received through the Inflation Reduction Act, among other measures, the bill will not significantly reduce the deficit. So, for experts like Dr. Lindsay Owens, Executive Director of the Groundwork Collaborative, measures like the increase in SNAP work requirements until age 54 represent a disservice to those who are meant to benefit from these programs: “Many low-income adults in this age range are in poor health. And as a result, they can’t necessarily work the number of hours or perhaps the physically demanding jobs that they’ve had throughout their careers. So, many will lose the basic assistance that they count on to buy groceries.” |